2008

The Managing Partners begin a deliberate hiring strategy to assemble a team of experienced professionals with a complementary and diverse set of expertise

Launch of the firm’s first fund, Antin Infrastructure Partners I

Fund I invests in Bina Istra, a toll road operator in Croatia

Fund I invests in Porterbrook, a UK rail rolling stock company

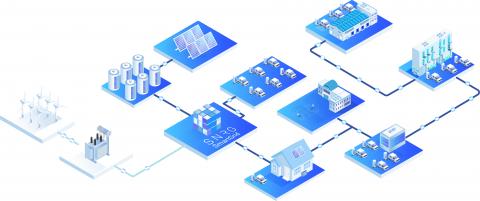

NextGen I invests in SNRG, a developer, installer and operator of smart grid networks in the UK.

NextGen I invests in SNRG, a developer, installer and operator of smart grid networks in the UK.